Become a Trusted Financial Leader

Fredonia’s AACSB-accredited B.S. in Public Accountancy is a 150-hour program that prepares you to meet the educational requirements for CPA licensure in New York and most U.S. states, all while maintaining affordable undergraduate tuition rates. Whether you aim to work in New York, Pennsylvania, Ohio, or beyond, Fredonia equips you with the tools to succeed as a CPA.

What You’ll Gain:

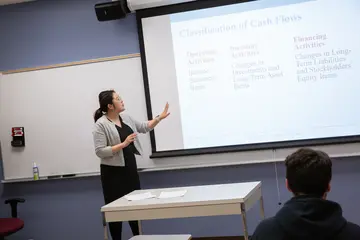

- CPA Readiness: Complete the required 150 hours for CPA licensure, with courses in financial accounting, auditing, and professional standards.

- Consulting Skills: Become a trusted financial advisor who helps individuals and businesses achieve their financial goals through tax and accounting expertise.

- Leadership Potential: Earning your CPA shows your commitment to taking on leadership roles and increasing responsibilities in your organization.

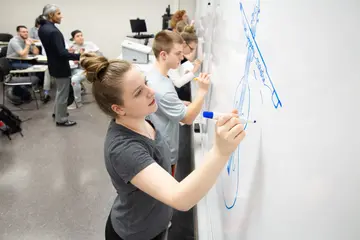

- Professional Networks: Engage with the active Accounting Society and build connections with professionals and alumni through speaker events and firm visits.

- Ethical Expertise: Gain a deep understanding of ethical practices in public accounting, ensuring you meet the highest professional standards.

Fredonia’s program ensures you are prepared for success in for-profit, non-profit, and public agencies, giving you the foundation to thrive in any setting. Ready to take the next step toward becoming a CPA?